Ace Maker DAO

Whitepaper

Ace Maker DAO is a decentralized finance platform (DeFi) that offers friendly services and apps for financial and economic activities, as well as venture investment in the multimedia industry. The platform is a DAO that runs on the Ace Maker protocol with open-source code, as part of the Ace Stream project. The goal of the platform is to provide secure and effective tools for decentralizing the multimedia market.

Definition of terms and brief explanations

The term "DAO" (Decentralized Autonomous Organization) refers to a complex form of smart contracts in which the rules of the decentralized organization are written into contract code and managed through tokens.

The term "decentralized multimedia market" refers to financial and economic activities related to the production of video and audio content, followed by its distribution and consumption in decentralized networks using peer-to-peer (P2P) data storage and streaming technologies (such as BitTorrent, Ace Stream, etc.)

About Ace Stream

Ace Stream is an international project aimed at building a decentralized media platform. It was developed actively in 2013 with support from the European Union.

Ace Stream is now the most popular decentralized multimedia platform for online streaming. It uses P2P (peer-to-peer) technology and has an environmentally friendly data storage and delivery system. This helps reduce CO2 emissions and protects the environment from damage caused by the centralized streaming industry and unicast technologies.

More than 30 million people use Ace Stream and it adds around 50,000 new users every day. People use it on their desktops, phones, TV boxes, and web browsers. This success has been achieved without any advertising or special incentives for users.

The Ace Maker DAO ecosystem is based on DLT (Distributed Ledger Technology) and does not have owners in the traditional sense; is owned by the community

The software operates in a decentralized, open network with a transparent economy based on embedded software algorithms presented in public smart contracts (open source codes) with complete decentralization of regulation of relationships, economic mechanisms, and settlements between its Participants. The rules of the Ace Maker DAO are maintained by the protocol (software code) itself, and all decisions regarding key system parameters are made by the social consensus of its Participants through voting.

The control rights of the Ace Maker DAO platform are distributed among the holders of AMD tokens. They manage the Ace Maker protocol and financial risks, ensuring stability, transparency, and efficiency of the protocol's operation. For this purpose, a scientifically-based management system is in place, which includes surveys and administrative voting.

All 100% of the AMD tokens are initially locked in the protocol. The primary placement (sale) on the market is carried out directly by the protocol itself (through smart contracts, with programmed pricing algorithms), and all funds generated from sales are automatically deposited into the Ace Maker DAO treasury and are fully controlled by the participants of the Ace Maker DAO (AMD holders).

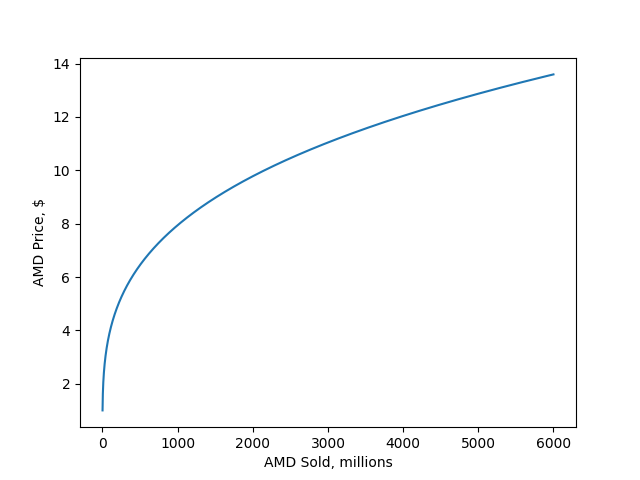

Price Calculator

Ace Maker DAO is introducing innovative technologies and financial tools to the media and crypto markets, offering unique solutions not found anywhere else.

The Ace Maker DAO platform leverages the exclusive features of Ace Stream to reach a vast audience of millions of users, providing a one-of-a-kind proposition for content creators and distributors that is irresistible. Content producers are offered the opportunity to unlock liquidity and significantly increase their capitalization through the tokenization of unused and unrecognized assets; monetize their content in decentralized P2P networks and receive large advance payments from the outset; eliminate the problem of piracy with the use of Ace Stream technology; and other unique opportunities, all without cannibalizing existing sources of income.

The Ace Maker protocol provides a mechanism for forming a self-governing investment pool, in the form of a DAO, for decentralized venture investment in the multimedia market, with a predicted minimum income level.

The ability to predict a minimum level of passive income from funds invested in the protocol is one of the key aspects that adds value to the Ace Maker protocol and to the AMD tokens.

Profit Calculator

To provide clarity, we will present the calculations for predicting the minimum level of profitability of the AMD token, based on the basic parameters of the protocol, taking into account only one of the sources of passive income forming the protocol's reward pool.

Holders of AMD tokens receive a privileged opportunity to become co-owners of broadcasting rights from leading global producers of premium content (sporting organizations, film studios, music labels, etc.) at the most favorable terms in the world and will receive passive income from the full cycle of content production, broadcasting and distribution, without the need for direct participation in any of these processes.

The presence of an automated content distribution system, enabled by the protocol, gives Ace Maker DAO another unique feature and added value

The Ace Maker protocol offers not only user-friendly services and apps that provide mechanisms for secure investing and income forecasting, but also loyalty mechanisms that allow AMD holders to exit the DAO with minimal costs. Withdrawing funds from the protocol in one year incurs a 1.5% commission fee, in two years - 0% fee. This loyalty program is only available to the participants who buy AMD tokens in rounds 1 to 100.

The Ace Maker protocol aims to minimize risk by reducing the possibility of losses to almost zero.

AMD tokens are expected to become a flagship product in the De-Fi market. This is because they are the first crypto asset to offer decentralized venture investment opportunities in the multimedia market, with minimal risk and a guaranteed minimum return that is ensured by the Ace Maker protocol (platform software code)

Along with DeFi programs, the Ace Maker protocol will provide the market with a new decentralized stable digital currency, with a soft peg to currencies of different countries (called Ace Coin). This currency will be backed by trustworthy and highly liquid digital assets, including the most valuable assets of the internet, such as broadcast and content access rights (premium content), unlimited CDN bandwidth with prepaid traffic (guaranteed internet bandwidth for delivering content to consumers), and advertising inventory in the most efficient formats.

The foundation of Ace Coin's stability lies in its connection to the most valuable assets of the Internet, which make up the backbone of the Internet and its consumer value (content consumption, content delivery, and monetization). These assets are protected from seizure and central regulation. This is what sets Ace Coin apart and should be the basis for any stable digital currency in a decentralized and independent Internet.

Ace Coin serves as a stable form of currency, preserving its value. It can be used just like traditional money, but with the added benefits of convenience and efficiency.

The Ace Coin, besides its standard features and capabilities, can also serve as a means of unlocking liquidity, generating investments, and boosting capitalization. Financial institutions and providers of goods and services can independently issue the required amount of Ace Coins, offering guarantees for their return to the protocol, to obtain low-cost investment resources without the need for creating and marketing their own tokens and stablecoins in the market. The Ace Maker protocol features flexible and reliable collateral mechanisms, offering favorable lending terms for Ace Coins with a fixed interest rate ranging from 0.5% to 3% per year, depending on the collateral and the borrower's creditworthiness. Additionally, the issuer is given the chance to multiply the Ace Coins they create and receive through the "Premium Asset" program. Through the Ace Maker protocol and the emission of Ace Coins, individuals can generate low-cost investments and grow their capital with minimal risk and without using their own funds.

For example

A bank can create the necessary amount of Ace Coins for itself, tied to the currency of its choice, by placing its digital bond or digital certificate in a collateralized storage facility (as a guarantee of its obligation to return the Ace Coins taken in debt to the protocol in a timely manner). In this way, the bank gains access to these stablecoins at an annual interest rate of 0.5% to 3% (depending on its rating) and can sell them through its own or authorized institution (with the appropriate license), thereby attracting cheap fiat money from the entire global internet community, not limited to its current territorial area of operation. Furthermore, the bank can allocate a portion of the stablecoins it creates to an investment pool within the protocol (through AMD), thereby having the opportunity to multiply its Ace Coins with the help of the "Premium Asset" program, and the ability to withdraw its invested stablecoins through a return mechanism, with a commission of only 1.5%

In such a model, the only "risk" for the bank is solely in terms of the amount of earnings - how much it will earn (more or less)!

Empower your finance with Ace Maker DAO: Take control, ensure stability, and drive efficiency!

Primary objectives¶

The primary objectives of the Ace Maker DAO are:

- To create a DeFi protocol that builds an ecosystem for effective decentralized financial and economic activity in the multimedia market and to improve the Internet as a whole.

- To protect the interests of copyright holders and legalize content in peer-to-peer networks, which is an integral component of the capitalization of the decentralized multimedia market and the operation of the Ace Maker protocol.

- To tokenize broadcasting rights and access to content with the automation of content distribution processes and placement of such crypto assets on the market.

- To form a self-regulated investment pool and create exclusive DeFi programs for decentralized venture investment in the multimedia market with minimal risk and a predictable minimum return.

- To implement a multi-currency mechanism for creating decentralized stable digital currencies, backed by highly liquid crypto assets and the most in-demand digital goods and services, with a soft peg to currencies of different countries.

DeFi Protocol for Multimedia Market¶

Our mission is to create a DeFi platform with efficient mechanisms and reliable tools for building a decentralized media market ecosystem, where the interests of all participants (investors, content creators, content distributors and consumers, software and hardware solution providers, etc.) are taken into account and protected.

By directing the development of the media market towards maximum decentralization, we aim to not only improve the media market, but also the entire Internet, making it the way it was originally intended and the way it should be in the end!

With the goal of establishing a decentralized financial and economic system in the multimedia market, the Ace Stream project has undergone restructuring, made necessary updates, and delegated part of its functionality to the Ace Maker protocol and its community (DAO).

The Ace Maker and Ace Stream tandem transforms the Network into a decentralized ecosystem for the production, broadcasting, and consumption of multimedia content. This ecosystem takes into account the interests of all its participants, including their requests and preferences, as well as social aspects and technical features of decentralized, open-source technologies.

Ace Maker and Ace Stream: Revolutionizing Multimedia¶

Ace Maker and Ace Stream are transforming the rules of the multimedia market.

By delegating a portion of its technological functionality to the Ace Maker protocol and its community (Ace Maker DAO, token holders of AMD), Ace Stream introduces a multitude of features that extend far beyond multimedia streaming. The most significant innovation is the integration of P2P streaming with P2P finance (also known as DLT - Distributed Ledger Technology).

Both P2P video/audio streaming and DLT are not new, but combining them together can fundamentally change the market. This combination opens up a multitude of possibilities, and here are just some of the capabilities being realized in the Ace Maker + Ace Stream tandem:

- The tokenization of broadcast rights and content access, which has a market volume measured in billions of dollars per year.

This means that tokens issued by Rightsholders (hereinafter referred to as "Rightsholder Tokens") will be backed by enforceable agreements where the rights and obligations of the parties are executed by smart contracts. As a result, rightsholders will be able to attract additional investments and significantly increase their capitalization, while the crypto market will be able to receive new high liquidity crypto assets worth billions of dollars into circulation.

-

The registration, transparent accounting, and tracking of media market assets through DLT.

-

Ace Stream technology offers new and unique opportunities for token issuers and their holders:

- Unlimited bandwidth, with access to the "last mile" and the ability to broadcast to an unlimited number of simultaneous viewers anywhere in the world (unlike centralized technologies such as Unicast). This is complemented by the ability to broadcast with the best audio-visual content quality, several times higher than the quality of centralized services, while delivery costs are almost 10 times lower compared to centralized CDNs.

- The ability to organize access to content based on any tariff plans (subscription for a period of time; one-time access; per-minute billing) without the need to register users on the content provider's portal.

- LTS (Legal Torrent Stream) - a system for legalizing and monetizing content in one-level (P2P, peer-to-peer) networks. This is a unique (unmatched in the world) and effective solution for combating "pirate" content in decentralized networks that provides 100% protection of the interests of rightsholders when content is uncontrolledly distributed through P2P technologies.

-

"Carbon Negative" Effect with the Use of P2P Broadcasting Technologies

The "Carbon Negative" effect is achieved by reducing the load from international trunks/data centers/CDN and redistributing it among the consumers’ devices that do not bear any additional energy load. As a result, when someone consumes content through Ace Stream or other P2P broadcasting technologies instead of alternative content consumption through centralized services and Unicast technologies, the amount of CO2 emissions into the atmosphere is reduced. If P2P technology is not used, the content consumption will occur in any case and in equal volumes, but only through Unicast technologies, with the corresponding CO2 emissions.

One hour of video viewing in the Ace Stream decentralized network using P2P technology instead of alternative video viewing through centralized online services and Unicast technologies, on average, reduces the amount of carbon emissions into the atmosphere by 131 g, which is equivalent to the average monthly level of decarbonization of one coniferous and deciduous tree (86 g and 143 g of carbon sequestration, respectively) that has been grown for 10 years.

More details here

-

Exclusive DeFi programs for reliable and predictable venture investment in the multimedia market.

The integration of protocols and smart contracts has laid the foundation for creating a business logic under which participants in the DeFi program Ace Maker protocol can become co-owners of broadcasting rights from leading global premium content producers (sporting organizations, movie studios, music labels, etc.), predict the protocol's profit and receive income from the full content production, broadcasting, and distribution cycle without the need for direct participation in any of these processes. On a programmatic level, conditions will be recorded and all obligations will be met with full assurance of mutual settlements between parties.

-

Tracking of traffic and time, which cannot be falsified, allows for precise automated mutual settlements between all participants.

- Low entry threshold for investing in the multimedia market due to decentralization and automation.

About the Ace Maker Protocol¶

The Ace Maker Protocol is a decentralized financial application built on the Ethereum blockchain.

Finance and economics are the foundation of stability and reliability in any system, especially in a decentralized one. That's why we didn't reinvent the wheel in such an important and responsible aspect, to avoid putting the Participants of the platform at risk, but rather use tried and tested technologies that have been proven over time and by millions of users.

The Ace Maker Protocol is built on the foundation of the Maker DAO protocol, one of the most reliable and advanced specialized platforms in the decentralized finance space. To ensure stability and reliability in our decentralized system, we have opted to leverage the tried and tested technology of Maker DAO, rather than reinventing the wheel. Our protocol incorporates the fundamental elements of Maker, while also adding new features and tools that are specifically tailored to the multimedia market through integration with the decentralized multimedia technology of Ace Stream. In essence, the Ace Maker Protocol offers all of the capabilities of the parent (base) protocol, but with additional enhancements and opportunities that are directly aligned with the multimedia market.

Ace Maker protocol offers the multimedia market with the necessary mechanisms and tools to carry out effective financial and economic activities in decentralized networks. In addition, Ace Maker protocol will play an equally important role in the cryptocurrency market. By integrating with the Ace Stream protocol, Ace Maker enables the creation and release of highly liquid tokenized assets backed by the most valuable and in-demand resources of the internet, such as:

- Broadcasting rights and access to premium content (TV channels, sports events, movies, series, music);

- Advertising inventory in the most sought-after formats;

- Unlimited P2P CDN bandwidth with prepaid traffic to ensure delivery of content to end-users anywhere in the world with maximum audio-visual quality and stability of broadcasts.

Protection of the Interests of Right Holders¶

Introduction¶

The decentralized media market, characterized by millions of users consuming multimedia content through P2P technologies with traffic volumes reaching as high as 25% of total international Internet traffic in some regions and trending upward, is a rapidly growing industry. However, despite its large audience and abundant high-quality content, it lacks financial economics and, as a result, remains un-monetized. This issue stems from two main factors:

- The absence of a solution that effectively protects the interests of content owners in this market segment

- The lack of mechanisms and financial instruments that would enable the effective monetization of content when published and distributed in decentralized P2P networks.

Streaming P2P Video in Current Realities¶

In the existing reality, P2P streaming video has become a significant part of the multimedia industry.

Peer-to-Peer (P2P) video streaming technologies are gaining increasing attention from broadcasters due to their undeniable advantages over traditional centralized (server and/or CDN) technologies. However, the absence of mechanisms to protect the interests of rights holders and the inability to monetize content using decentralized broadcasting technologies forces rights holders to rely on centralized CDN solutions. The provision of modern formats (4K) and quality content delivery to a large number of users leads to massive capital expenditures (servers, CDN, dedicated data centers, etc.) and operational expenses (ensuring broadband capacity, energy consumption, and a large number of personnel), which ultimately causes significant harm to the environment and the Internet as a whole and results in high prices for end-users. This, in turn, leads to high demand for "pirated" content. Eco-friendly and convenient P2P solutions, which provide the same or better user experience, are usually much cheaper, although they are completely devoid of centralized management capabilities. This combination of features makes P2P networks particularly attractive to "pirates," which effectively creates another massive problem in the form of the widespread distribution of unlicensed content in decentralized networks, resulting in huge harm to the entire multimedia industry.

Relevance of the Problem of “Piracy”¶

The combined losses incurred by content owners due to illegal production and distribution of content have reached $2.3 trillion in 2022, according to the Frontier Economics analytical agency.

According to data from the U.S. Chamber of Commerce’s Global Innovation Policy Center, piracy of digital video reduces the overall revenue of the industry by 11% to 24%. The study estimates that "online piracy" costs the economy of just one country, such as the United States, a minimum of $29.2 billion in lost profits each year. And these are the most conservative estimates!

The Continued Relevance of Content Piracy: An Analysis of Consumer Behavior

On the day of the premier of the first episode of the 8th season of the popular television show "Game of Thrones," a reported 3.39 million individuals in the United Kingdom viewed it on Sky Atlantic, while 17.4 million residents in the United States viewed the episode on HBO within the first 24 hours of its release. However, these figures are overshadowed by the number of individuals who utilized unauthorized streams and torrents to view the episode. Digital piracy agency MUSO recorded 54 million illegal views of the first episode of the 8th season within the first 24 hours of its release.

These data demonstrate that consumers continue to turn to unauthorized sources in search of content, despite significant global efforts to combat piracy in recent years, and once again highlights the inefficacy of current standard methods for combating the dissemination of unlicensed content.

The Achilles' heel of the sports industry¶

The issue of "piracy" is relatively new to the sports industry, as sports leagues were previously not significantly impacted by this problem due to the unique characteristics of the industry. Many in the sports industry still believe that everything is fine, but the truth is that the growth of revenue from the sale of sports rights, which was once considered to be endless, has come to an end, leaving the industry completely unprepared to face the realities and address the major challenges posed by the new decentralized technologies and the growing spread of unlicensed sports transmissions.

The problem is worth over 36 billion dollars per year!

The global market for the rights to broadcast sporting events is estimated to be approximately $50 billion annually, according to foreign research agencies. Meanwhile, more than half of sports fans (51%) watch at least one "pirated" (unlicensed) sports broadcast per month, according to research company Ampere Analysis. A survey conducted by Synamedia revealed that among those who watch illegal sports broadcasts, 42% consume sports content on a daily basis.

The study was conducted in 10 countries and

involved around 6,000 sports fans, according to Broadband TV News

It can be confidently assumed that the level of unauthorized viewing reduces the overall revenue of the industry by 42% to 51%, leading to the sports industry missing out on over 36.2 billion dollars in yearly revenue, plus the cumulative profits of all licensed sports broadcasters.

The issue of piracy is particularly dangerous for the sports industry, as once major broadcasters (buyers of sports broadcast rights) fully understand the extent of unauthorized sports broadcasts, they may begin to view all rights to sports as non-exclusive, leading to a significant decrease in current revenue from the sale of licensed broadcast rights. This is already happening.

The CEO of beIN Media Group, Youssef Al-Obaidly, emphasized the urgency of the "piracy" problem during an industry summit and stated that the "glorious media rights bubble" is about to burst, predicting that the economic model of the industry will be completely rewritten.

At present, there is no satisfactory solution to this problem. Efforts to take legal action against pirates using P2P distribution channels (such as BitTorrent) face numerous technical and legal difficulties and have limited potential for success. BitTorrent clients (as well as Ace Stream clients) are merely the means of transport and cannot control what their users download or view. Traffic filtering not only undermines the principle of network neutrality and borders on censorship, but is also extremely costly and can easily be bypassed by even moderately tech-savvy internet users. This clearly demonstrates that the policy of legal and technological restrictions is no longer effective in the changing technological context, and anyone who wants to see their assets protected must seek more adequate solutions.

Changes in the Media Landscape¶

The majority of rightsholders, particularly sports leagues and broadcast rights owners, are troubled by the proliferation and widespread distribution of unlicensed transmissions in P2P (peer-to-peer) networks, such as Sop Cast and Ace Stream. While these technologies are themselves lawful and legitimate, they also happen to be accessible and effective broadcast technologies, providing anyone with the opportunity to use them for any purpose, including unlicensed broadcasting. In the case of Ace Stream, it is also a fully decentralized technology, with no means of blocking any broadcast, unlike the partially decentralized SopCast and centralized services.

For a long time, rightsholders have repeatedly approached Ace Stream to find an effective solution to the active widespread distribution of unlicensed content through the use of decentralized technologies like Ace Stream.

Ace Stream envisions its future as a universal decentralized multimedia delivery network, providing legal content and considering the interests of all participants in such a network. Therefore, resolving the cluster of issues described above is imperative.

Commercialization instead of censorship¶

Ace Stream's approach to protecting the interests of rightsholders involves providing new mechanisms and financial tools that enable rightsholders to monetize their assets in a more flexible manner, aligned with contemporary content distribution channels. In this way, piracy can be defeated economically, rather than by force!

Legal Torrent Stream (LTS) - system of legalization and monetization in Peer to Peer networks.

The LTS system, at the software level, ensures that the rights holder is paid for each minute of playback of their content when using Ace Stream technology, regardless of who is distributing the content and through which websites, services, or applications, and on which devices the playback will be carried out.

Technological guarantees

Ace Network has unique feature of fully decentralized and transparent traffic and watching time accounting system and payment system based on most advanced blockchain technology.

Rightsholders will get paid automatically and will be provided with tools for Network monitoring and audit to be absolutely confident about reliability of statistics of watched minutes and correctness of payments.

The network's node code is open source.

To incentivize rightsholders to utilize LTS and actively participate in the proposed decentralized ecosystem, the mechanisms of the Ace Maker protocol provide the opportunity for rightsholders to receive an advance payment, equal to 10% of their total revenue from the sale of broadcasting rights for the previous yearly period.

For example, if the total yearly revenue of the English Premier League (EPL) from the sale of TV rights and centralized streaming services was 5 billion dollars, then utilizing the Ace Maker offer, this organization could receive an advance payment from the decentralized market in the amount of 500 million dollars, as additional income without cannibalizing their other sources of revenue.

Why LTS is a genuine instrument in elimination of pirated content in P2P networks and whether Ace Stream will be effective?

Genuineness and efficiency of the Ace Stream solution is that it is fully decentralized and automated, and its program algorithms rely on compromise which considers interests of all parties, including bad actors (“pirates”), and all parties get unique features and opportunities.

Opportunities for copyright holders¶

- Maximum audience reach and monetization of content in decentralized P2P networks with an automated distribution system, providing access to a new and previously untapped market segment with a multi-million audience, capable of generating additional revenue streams without affecting other sources of income.

-

Solving the issue of widespread distribution of unlicensed content in decentralized networks, where it is not possible to block it through legal or technological means.

Guaranteed payment to the rightsholder for each minute of content reproduction in the Ace Stream network.

-

Unlocking liquidity and increasing capitalization by creating new highly liquid crypto assets (issuing proprietary digital assets backed by rights to broadcast and access to content in decentralized P2P networks), attracting investment capital from the crypto market through token sales on auctions and exchanges, as well as direct sales.

-

Broadcasting to an unlimited number of simultaneous viewers, in the best quality, to any location worldwide.

No technical limits for the amount of simultaneous viewers online (in contrary to common technologies like unicast). It is complemented by the best audio visual quality of broadcasts and minimal expenses on content delivery (up to 10 times cheaper than with Unicast) for independent broadcasting of own content.

-

Control of advertisement views related to copyrighted content in the Ace Stream Network.

- Partnership programs with Network members for better monetization of content (Live Bets, In-Play Bets, Marketplaces etc.).

- Positive impact on the environment through the use of eco-friendly P2P CDN.

- Improved image through interaction with advanced internet users, who are largely adopters of decentralized technologies.

Opportunities for "Pirates"¶

- Broadcasters and website/app owners who publish and distribute copyrighted content without proper licensing are given the chance to legitimize their services, earn revenue from legal distribution, and increase their profits without incurring additional costs, bureaucracy, or direct interaction with rightsholders.

Advantages for Users¶

- Users will continue to enjoy services and applications with the functionality they are accustomed to, which is not available in centralized services, as well as additional features, such as:

- Access to all necessary TV channels, sports events, movies, TV shows, music, without registration

- Convenient search and cataloging, with the ability to play content anywhere and any way, without being limited to a specific site, application, player, and device

- The highest possible "true" audio-visual quality of content, several times higher than the quality of centralized services

- Flexible approach to tariff plans and premium content packaging, with business models that they can afford

- Receiving bonuses and rewards: for providing their hardware and network resources; for publishing and distributing content; for watching advertisements; for moderating content and actively participating in the life and development of the Network.

DAO Governance Tokens¶

Owners of rights, as well as platform developers and any internet users, have the opportunity to engage in the development of policies and protocols of Ace Stream and Ace Maker through the use of DAO governance tokens.

One-of-a-kind offer that's too good to pass up¶

The synergy of Ace Stream and Ace Maker creates a no-brainer offer on a software level, benefiting all platform participants and network users.

Ace Maker's unique proposition for rightsholders lies in the fact that today, only the Ace Stream network and Ace Maker protocols possess all the necessary components to effectively protect the interests of rightsholders in decentralized P2P networks.

Without protection mechanisms for rightsholders in the world's most popular decentralized online broadcasting network (Ace Stream), which is rapidly growing and globally used by various broadcasters, and the lack of legal and technological means to remove unauthorized content from the network, the problem of widespread unauthorized content cannot be solved.

Ace Maker invites rightsholders to thoroughly explore the capabilities offered by the protocol and carefully evaluate its prospects for use or rejection, to make a simple and obvious choice.

A Simple and Obvious Choice for Rights Holders

What rights holders need to consider to make an informed decision?

Today's technology landscape already allows for not only decentralized P2P broadcasting, but also the formation of a fully decentralized economy with the highest level of privacy and anonymity, as well as the ability to build fully decentralized services and funding mechanisms that cannot be blocked or hindered in any way. This means that all current standard methods of combating the distribution of unlicensed content (such as removing content from websites upon request by rights holders, blocking websites entirely, limiting the operation of "pirate" services with financial institutions, identifying the organizers of unlicensed broadcasting and the physical location of their servers for the purpose of bringing legal action and confiscating the equipment of copyright infringers, etc.) will soon stop working altogether and will no longer yield any positive results.

As a result, rights holders are faced with a simple and obvious choice, consisting of only two options:

- Utilize the proposed decentralized mechanisms (protocols and smart contracts) to effectively solve the "piracy" problem, enter a new market, and reap the benefits of a wide range of new opportunities that will provide substantial profit for rights holders, or

- Decline the offered opportunities and passively observe the widespread distribution of their content in decentralized P2P networks, which will continue to grow and cannot be stopped by any legal or technical means, thus continuing to feed the mills of the "pirates."

Andy Chatterley, CEO of MUSO

It is important copyright holders understand the pirate audience is one of their most loyal fans who mainly presents a huge commercial opportunity

Tokenization of broadcast and access rights¶

Tokenization is a method of issuing a new financial instrument to attract investments, using secure DLT technology, allowing to attract a global Internet audience to purchase such assets and secure high consumer confidence.

The Ace Maker protocol provides a mechanism for tokenizing rights to broadcast content and access rights to content by issuing two types of tokens:

- Copyright holder tokens - tokens backed by the rights to broadcast, providing access to the issuer's content, both created and to be created in the future.

- Content provider tokens - tokens backed by the rights of access to the services and offerings of content providers.

The responsibility for linking content with the copyright holder falls on the Oracle

Oracle is a bridge between the offline world and the decentralized system. In a real world Oracle is a company that can make legal decisions and execute actions based on these decisions in the blockchain. Oracles can be added or removed from the blockchain by vote of network owners.

Tokens issued by content producers and content providers represent materialized agreements where rights and obligations are executed through smart contracts. These tokens essentially become specialized currencies created to pay for specific goods or services. To access protected content and services provided by content providers, one must first purchase these "specialized currencies" (tokens). This purchasing process can be fully automated and seamless for users, while also being convenient for content providers.

The rights provided by these tokens are valid indefinitely and only cease to exist upon their utilization (when the services are received and the token is utilized).

Token issuance can be done through various user interfaces, including the basic system portal Eden and various interfaces developed by the community.

Copyright Holder Token¶

Copyright holder tokens are only created by the content producer and will be used in the future to access premium, copyright-protected content.

This type of token can only be used to access premium (paid) content that is not freely available. For example, if the token issuer places some of their content on YouTube or somewhere else that is freely accessible, this token will not be used to pay for access to that content (network users and oracles are responsible for enforcing these conditions).

In other words, Ace Stream network users will automatically receive the rights to access such content for free (without using tokens), while the copyright holder will have the right and opportunity to activate the advertising monetization model for such content, subject to payment for traffic.

These tokens are in compliance with the ERC20 standard. Each token contains:

- One hour of access to the issuer's content

- Classifier: AVoD (Audio and Video on Demand) or Live (Live Streams)

- Tokenized amount of one hour's worth of data transmission in the Ace Stream P2P CDN (1 AceTime, which is automatically generated at the time of token issuance)

The issuance of this kind of tokens should be carried out by rights holders for the following purposes:

- To tokenize the rights to broadcast their premium content, which has already been created and will be created in the future, with the aim of unlocking liquidity and increasing their capitalization, by obtaining additional sources of revenue funding through the creation of new highly liquid crypto assets and attracting investment capital from the crypto market.

- To provide the rights to broadcast to third parties, on the conditions of payment for access to their content through tokens issued by them.

- To use the LTS mechanism, which ensures the protection of the rights holders' interests in the Network.

- To monetize content in a decentralized P2P network with the involvement of per-minute billing.

This type of token has additional backing in the form of pre-purchased, tokenized bandwidth in a P2P CDN network, which is acquired by the Ace Maker protocol at a discounted rate. This ensures that token holders have a reliable P2P CDN system and the ability to deliver high-quality content to end-users with minimal CDN costs.

In other words, up to 95% of the costs typically incurred by content providers for content delivery to end-users are embedded in the structure of these tokens and covered by the Ace Maker protocol. This provides content providers with the most favorable conditions in the world, both in terms of acquiring rights to content and delivering it to end-users.

To issue this type of token, the rights holder signs a contract with the Oracle and submits a token issuance request through any convenient network portal. Optionally, issuers may receive an advance payment at the time of token creation, equal to 10% of the issuance volume. This amount is calculated based on the nominal token price and paid from the DAO treasury funds, subject to approval by the DAO participants via voting.

The system's fee for token issuance and management is 30% of the issued token volume (set by system settings and subject to change by DAO voting).

Application Submission¶

A token issuance application is submitted by the rights holder or agent and contains the following information:

- Address of the electronic version of the contract in the IPFS network

- Token name

- Token classifier:

- AVoD (audio and video on demand)

- Live (live broadcasts)

- Traffic classifier:

- multimedia (video + audio)

- audio

- Token nominal price (expressed in stablecoins)

- Currency to which the token being issued will be linked (USD, EUR, or others supported by the system)

- Issuance volume (the value of tokens issued should not exceed three times the total revenue from the sale of broadcast rights for the previous fiscal year, based on the nominal price of the token. The optimal value is equal to the annual value)

- Volume of tokens for primary sale, guaranteed for buyout (the issuer indicates the percentage of tokens from the total issuance that must be immediately bought out by the protocol at the nominal price, at the time of their issuance)

- Application validity period

- Oracle account address (responsible for confirming copyright and signing the off-chain contract)

- Agent account address (deal organizer responsible for ensuring the rights and interests of the issuer within the system)

Application parameters:

ipfsContractAddress: the IPFS network address of the electronic version of the contracttokenName: the name of the issued tokentokenClass: the token classifier (live or AVoD)trafficClass: the traffic classifier (multimedia or audio)tokenBasicValue: the nominal price of the token expressed in stablecoinstokenCurrency: the currency of the tokentokenAmount: the amount of tokens to be issuedpresaleShare: the amount of tokens for the initial sale at nominal value (in percent)maxDuration: the duration of the applicationoracleAccount: the address of the oracle accountagentAccount: the address of the agent account

After submitting the application, it must be approved by authorized participants in the following order:

- The Oracle (specified in the application)

- Ace Stream DAO representative (authorized account)

- Ace Maker DAO, if a primary sale has been declared.

If there is no primary sale (presaleShare is set to zero), approval from Ace Maker DAO is not required.

If the application is not approved within the specified maxDuration, it will automatically be cancelled.

Token Issuance¶

The issuance of copyright holder tokens is performed using the issueTokens method of the TokenizedCopyrightsManager smart contract. This method is automatically triggered upon approval of the application by the system participants (as per the aforementioned procedure).

If a presale volume was specified in the request, then at the time of issuance, Ace Maker DAO automatically purchases the specified volume of tokens at the nominal price using funds from the Ace Maker DAO treasury. The issued tokens are placed in the basic asset storage, which is automatically created during issuance.

If there is no presale in the application, then the issued tokens are not classified as a basic asset of the protocol and after issuance, they are placed in a special system storage designated for storing tokens that have been passed on to the protocol to be sold.

Also at the time of issuance, the smart contract uses the "AceByte" tokens to create the "AceTime" tokens, which are encapsulated in the copyright holder tokens in an amount that corresponds to the volume of rights generated for access to the issuer's content. The necessary volume of AceByte tokens is determined by the Ace Stream smart contracts responsible for the automatic issuance of time tokens.

In order to reduce the cost of content delivery, "AceByte" tokens are initially purchased from the Ace Stream DAO in the amount of 1 billion tokens with a 75% discount.

Token definitions:

- AceByte (XAB) - native token of the Ace Stream network, backed by guaranteed P2P CDN bandwidth and used for traffic accounting purposes with a ratio of 1 AceByte = 100 GB of traffic. AceBytes are necessary for creating AceTime tokens, based on one hour of content playback, taking into account the average traffic consumption in the Ace Stream Network.

-

AceTime (XAT) - algorithmic token, backed by the amount of consumed traffic, in a ratio of one hour of video and/or audio content playback. AceTime tokens can be used to pay for one hour of content delivery in the Ace Stream P2P CDN, regardless of the amount of GB used.

The Ace Time token is technically represented by a set of multiple tokens, each of which is tied to a specific type of content:

- Ace Time Multimedia - a token that can be used to pay for the delivery of one hour of multimedia content (audio + video)

- Ace Time Audio - a token that can be used to pay for the delivery of one hour of audio content

To create one AceTime token, a certain number of AceByte tokens are required, calculated as follows:

aceTimePrice = trafficRate / 100where:

aceTimePrice- the number of AceByte tokens needed to create one AceTime tokentrafficRate- the average level of traffic consumption for the corresponding type (multimedia, audio) in the Ace Stream network (GB/hour)

Circulation of rights holder tokens¶

Once issued, all tokens go into the appropriate vault and serve for intra-system operations, such as: pricing and confirming the volume of rights; distributing revenue to the owners of the copyright holder tokens, in the form of deductions when paying for access to content. At the same time, the owners of tokens can dispose of the rights to those tokens in a seamless and most convenient way, through NFT.

Each token holder is issued an OwnerNFT - a non-exchangeable token (NFT) representing the rights to own a certain share of the issuer's tokens. Owners have the ability to transfer their share (in whole or in part) to another owner (by transferring/selling OwnerNFT)

The Contract Algorithm¶

- The issuance of

tokenAmounttokens takes place. - Using the smart contract

AceTimeManager(Ace Stream DAO), the amountaceByteAmountof AceByte tokens required to createtokenAmountAceTime tokens is calculated. aceByteAmountof AceByte tokens is transferred to theAceTimeManagercontract.- The

AceTimeManagercontract createstokenAmountAceTime tokens. These tokens are encapsulated in the issued copyright holder tokens. trafficTokenPriceis calculated - the cost of one AceTime token in stablecoins based onaceByteAmountand the price at which the Ace Maker DAO purchased the AceByte tokens.- If a primary sale is specified in the request (

presaleAmount > 0):- Payment for the purchase of primary sale tokens (in stablecoins) is transferred from the Ace Maker DAO treasury to the issuer's account:

presaleAmount = tokenAmount * presaleShare% * tokenBasicValue

- A new vault is created for basic assets with a specified liquidity ratio (this parameter is passed when the request is finally confirmed by a DAO vote).

- The issued tokens are placed in the created vault.

- As a result of the asset being deposited in vault, stablecoin emission takes place in the amount of:

aceCoinIssueAmount = tokenAmount * tokenBasicValue / liquidityRatio

- Payment for the purchase of primary sale tokens (in stablecoins) is transferred from the Ace Maker DAO treasury to the issuer's account:

- The issued stablecoins are transferred to the Ace Maker DAO treasury.

- If there is no primary sale, the issued tokens are placed in a special system storage designated for storing tokens passed to the protocol to be sold.

- The token owners are assigned:

- Ace Maker DAO - in the amount of the system fee plus

presaleShare(the primary sale volume), minus oracle and agent's reward and contributions to charity, development and marketing - Agent - a percentage of the system fee is paid to the agent (system setting)

- Ace Maker DAO Charity Treasury - 10% of the system fee minus oracle and agent reward

- Ace Maker DAO Development Treasury - 5% of the system fee minus oracle and agent reward

- Ace Maker DAO Marketing Treasury - 5% of the system fee minus oracle and agent reward

- Issuer - the rest of the emission volume

- Ace Maker DAO - in the amount of the system fee plus

- An OwnerNFT is generated for each owner.

- The values of

tokenBasicValue,tokenCurrency,trafficTokenPrice,tokenClassandtrafficClassare recorded on the blockchain (used in later algorithms to pay for access to content).

Token Issuance Example

For this example, we'll use the following input data:

- Token name: CHT

- Token classifier: live (live broadcasts)

- Traffic classifier: multimedia (multimedia traffic)

- Token issuance volume: 1000 CHT (corresponds to 1000 hours of viewing)

- Current level of multimedia traffic consumption in the Ace Stream network: 4 GB/hour

- Price at which Ace Maker DAO purchased AceByte tokens: 0.25 USD

- Token currency: USD

- Nominal token price: 0.04 USD

- Liquidity ratio: 1.5

- Initial sale volume: 10%

- Application validity period: 3 months

- System fee: 30%

- Oracle and agent reward: 10% of the system fee

- Charity contributions: 10% of the system fee minus oracle and agent reward

- For development: 5% of the system fee minus oracle and agent reward

- For marketing: 5% of the system fee minus oracle and agent reward

After the application is submitted, authorized participants have 3 months to sign it, otherwise the application will be canceled.

The application includes an initial sale, so final confirmation is done by voting of Ace Maker DAO and the emitted tokens are placed in the base asset storage with the specified liquidity ratio (1.5). The issuance of tokens is executed at the time of application confirmation, in the same transaction. This is done by calling the issueTokens method of the TokenizedCopyrightsManager smart contract, which performs the following actions:

- A storage for base assets with a liquidity ratio of 1.5 is created

- 1000 CHT are emitted and placed in the created storage

- 26.67 USD stablecoins (1000 * 0.04 / 1.5) are emitted and transferred to the Ace Maker DAO treasury

- The emitted tokens will encapsulate AceTimeMultimedia tokens because the traffic classifier is “multimedia”

- The number of AceByte tokens needed to create AceTimeMultimedia tokens is calculated:

- formula:

aceTimePrice = trafficRateMultimedia / 100 aceTimePrice = 4 / 100 = 0.04(this is the number of AceByte tokens needed to create one AceTimeMultimedia token)- To create 1000 AceTimeMultimedia tokens, 1000 * 0.04 = 40 AceByte tokens are needed

- 40 AceByte tokens are transferred to the AceTimeManager contract. 1000 AceTimeMultimedia tokens are created and encapsulated in the emitted tokens

- formula:

- trafficTokenPrice, the cost of one AceTimeMultimedia token in stablecoins, is calculated:

- formula:

trafficTokenPrice = aceTimePrice * aceBytePurchasePrice, where:trafficTokenPrice- cost of one AceTimeMultimedia token in stablecoinsaceTimePrice- number of AceByte tokens needed to create one AceTimeMultimedia tokenaceBytePurchasePrice- price at which Ace Maker DAO purchased AceByte tokens

- calculation:

trafficTokenPrice = 0.04 * 0.25 = 0.01 stablecoins

- formula:

- 4 stablecoins are transferred from the Ace Maker DAO treasury to the emitter's account (this is payment for the initial sale: 1000 * 0.04 * 10% = 4)

-

Token owners are assigned:

- 60% - emitter

- 31.6% - Ace Maker DAO (30% system fee, plus 10% of the volume of the initial sale, minus 3% oracle and agent rewards, minus charity, development and marketing contributions)

- 3% - oracle and agent rewards (10% of the system fee)

- 2.7% - Ace Maker DAO Charity Treasury

- 1.35% - Ace Maker DAO Development Treasury

- 1.35% - Ace Maker DAO Marketing Treasury

-

An OwnerNFT is generated for each owner, confirming their right to hold CHT tokens.

Pricing¶

To determine the real value of tokenized assets for right holders, pricing is carried out in several stages, forming three pricing positions:

Nominal Price¶

The nominal price is the minimum price set taking into account the possible transaction.

When tokens are issued, the issuer and authorized oracles of the Ace Stream and Ace Maker networks establish the minimum price at which the tokens are offered to the first owners when they are initially placed.

Fair Price¶

The fair price is the price reflecting all future income or utility that the token can bring to the right holder. It is formed through the conduct of open auctions, involving professional participants of the multimedia market.

To form the fair price of the copyright holder tokens, an auction is held. A portion of the OwnerNFTs received by the system in the form of fees is put up for auction. The volume of OwnerNFTs put up for auction is 5% to 10% of the total issuance of the copyright holder tokens and can be changed by a DAO vote.

The auction takes place in two stages:

- First stage: English auction

- OwnerNFTs are put up for sale in fixed lots at a price equal to the sum of the nominal price (

tokenBasicValue) and the price of the AceTime token (trafficTokenPrice). - The first participant must offer a price not lower than the initial price of the lot.

- Each subsequent participant must offer a higher price than the previous participant.

- If the next bid is not exceeded within a certain time, the second stage starts.

- If there were no bids at the auction within a certain time, the auction is restarted.

- OwnerNFTs are put up for sale in fixed lots at a price equal to the sum of the nominal price (

- Second stage: Dutch auction

- A lot from the first stage is put up for sale at an inflated price (130% of the maximum bid of the first stage).

- Every 90 seconds, the lot price decreases by 1%.

- The participant can buy the whole or part of the lot at the current price at any time.

- The auction ends when the entire lot is sold.

- The auction is restarted if the lot was not sold within a certain period of time, or if the lot price fell below a certain value.

- All auction parameters are set by system settings.

Market Price¶

The market price is the price of access to content that is formed on the market in accordance with demand and supply.

After the auctions, the copyright holder tokens are placed on exchanges at the formed fair price to determine the exchange rate, which is affected by yield, reliability, and many other factors.

This exchange rate (market price) is received by the protocol from the oracles in real-time and determines the price limit, which sets the minimum token price (corresponding to the cost for 1 hour of video playback), guaranteed for payment to the right holder at the software level (protocol, smart contract). In the event that any broadcaster sets a price below this price limit, the price will be automatically adjusted by the oracle to the minimum limit level. This limit is set in the smart contract and is guaranteed by the protocol.

Automated Management and Distribution¶

The automation of management and distribution processes for the purpose of providing passive income to OwnerNFT holders is unique and an added value of this token. The functionality of the Ace Stream protocol and Ace Maker smart contracts has allowed the implementation of a business logic in which the owners of this type of token can earn income not only from speculative operations but also from the entire content production, broadcasting and distribution cycle without the need for direct participation in any of these processes. At the software level, the conditions will be recorded and all obligations of the parties will be fulfilled with full guarantees of mutual settlements.

Holders of OwnerNFTs (owners of copyright holder tokens stored in the system storage) receive a portion of the income from the payment for access to content, in accordance with the conditions of the ContentAccessPayment smart contract.

ContentAccessPayment is a system smart contract that is responsible for processing payments received as payment for access to content.

Contract Description¶

This contract is triggered upon a user's payment for access to content. The cost of access is dynamically calculated and includes the following components:

- Cost of copyright holder tokens (calculated based on hours of viewing and a fair token price)

- OwnerNFT holders fee (expressed as a percentage, system setting)

- Broadcaster fee (in stablecoins, set by the broadcaster)

- Distributor fee (in stablecoins, set by the distributor)

- System transaction fee (in stablecoins, system setting)

The funds received from the user are distributed according to the components listed above:

- OwnerNFT holders receive:

- the amount equal to the fair cost of copyright holder tokens, minus the cost of encapsulated AceTime tokens

- a fee in the form of a percentage of the fair cost

- The broadcaster and distributor receive their respective fees

- The system transaction fee

The portion of the OwnerNFT holders is distributed proportionally based on their ownership ratios of the issuer tokens in the Ace Maker protocol.

This contract burns the issuer tokens used for access to their content. The AceTime tokens, which were contained within the issuer token for payment of content delivery, are released and transferred to the RewardUploadersManager contract for distribution among viewers through a "lottery" system.

The "Lottery" System¶

The Lottery System is an automatic reward system that incentivizes viewers to use P2P technologies by financially rewarding them for providing the Network with their hardware and network resources.

This system performs a raffle of rewards among users who actively participated in seeding content (providing traffic to other users).

Algorithm

The smart contract RewardUploadersManager is responsible for the implementation of the Lottery System.

- To participate in the raffle, users must have contributed at least 1 GB of traffic.

- For every 1 GB of traffic provided, the participant receives 1 lot.

- The raffle is held every 28 days, triggered by calling the

rewardmethod, which randomly selects winning lots and transfers the reward to them. - The maximum number of lots per user is calculated using the formula:

maxLots = accessPrice / trafficPrice, where:accessPriceis the cost of access to content (in stablecoins)trafficPriceis the cost of 1 GB of traffic in stablecoins (currently 0.01$ per 1 GB)

- The winning coefficient is 1:100:

- every 100th lot is a winning one

- the winning lot receives a reward equivalent to the cost of 100 GB of traffic

The winning coefficient can be changed by a vote of the Ace Maker DAO.

The Lottery System provides a fair and transparent way of distributing rewards among users who contribute to the network's traffic, motivating them to continue to participate actively in the network

Contract Algorithm¶

Parameters

sourceAccount: the user (viewer) account that pays for access to the content.issuerAccount: the account of the copyright holder tokens issuer.broadcasterAccount: the account of the broadcaster.distributorAccount: the account of the distributor.accessAmount: the consumption volume (number of hours of viewing).

Algorithm

- Find the issuer's token contract

chTokenusingissuerAccountas reference - If

sourceAccountholdschTokentokens:tokenCostis set to 0- Burn

accessAmountof issuer's tokens fromsourceAccount

-

If sourceAccount does not hold

chTokentokens:- Request the current fair price of

chTokentoken (chTokenFairPrice) from the system -

Calculate the cost of issuer's tokens:

tokenCost = accessAmount * chTokenFairPrice -

Deduct the cost of encapsulated AceTime tokens:

trafficCost = accessAmount * chToken.trafficTokenPrice tokenCost = tokenCost - trafficCost -

Calculate the fee for OwnerNFT holders:

tokenMarginCost = tokenCost * SystemSettings.content_access_owner_nft_margin -

Burn accessAmount of issuer's tokens from the system storage

- Deduct

tokenCost + tokenMarginCoststablecoins fromsourceAccountand distribute among OwnerNFT holders - Burn

trafficCoststablecoins

- Request the current fair price of

-

Calculate the broadcaster's fee:

broadcasterFee = accessAmount * broadcasterAccount.fee -

Calculate the distributor's fee:

distributorFee = accessAmount * distributorAccount.fee -

Transfer all the AceTime tokens contained in the issuer's tokens to the

RewardUploadersManagercontract for distribution among viewers through the "lottery" system. -

Transfer

broadcasterFeestablecoins from sourceAccount to broadcasterAccount -

Transfer

distributorFeestablecoins from sourceAccount to distributorAccount -

Deduct

SystemSettings.network_feestablecoins (fixed transaction fee of the system) from sourceAccount.

Examples¶

Example 1 (user does not have copyright holder tokens)

For the example, let's use the following inputs:

- consumption volume: 100 hours of viewing

- copyright holder token name: CHT

- copyright holder token contract address: chtContract

- user does not have CHT tokens

- current fair price of the token: 1 CHT = 0.05 stablecoins

- price of encapsulated AceTime token: 0.01 stablecoin

- OwnerNFT holders' fee: 10%

- OwnerNFT holders list:

- 25% - Ace Maker DAO

- 15% - ownerA

- 60% - ownerB

- system fee: 0.02 stablecoin

- broadcaster fee: 0.01 stablecoin per hour

- distributor fee: 0.015 stablecoin per hour

As a result of the ContentAccessPayment smart contract execution, the following actions are performed:

- 100 CHT are burned from the system storage

- 100 AceTime tokens (contained within 100 CHT) are transferred to RewardUploadersManager contract for distribution among viewers through a "lottery" system

- cost of the burned CHT is calculated: 5 stablecoins (100 CHT were burned, fair price of each is 0.05 stablecoin)

- cost of encapsulated AceTime tokens: 1 stablecoin (100 * 0.01)

- OwnerNFT holders' fee: 0.4 ((5 - 1) * 10%)

- broadcaster fee: 1 stablecoin (100 hours * 0.01)

- distributor fee: 1.5 stablecoins (100 hours * 0.015)

- 7.9 stablecoins are deducted from the user (5 + 0.4 + 1 + 1.5) and distributed as follows:

- 4.4 is distributed among OwnerNFT holders (fair cost minus AceTime token cost plus fee 10%):

- 1.1 is transferred to the Ace Maker DAO treasury (25%)

- 0.66 is transferred to ownerA's account (15%)

- 2.64 is transferred to ownerB's account (60%)

- 1 is transferred to the broadcaster

- 1.5 is transferred to the distributor

- 1 is burned (cost of encapsulated AceTime tokens)

- 4.4 is distributed among OwnerNFT holders (fair cost minus AceTime token cost plus fee 10%):

- 0.02 is deducted from the user (system transaction fee)

Example 2 (user has copyright holder tokens)

In this example, the inputs are the same as in the previous example, with the exception of:

- user has 100 CHT on their account

Result of the smart contract execution:

- 100 CHT are burned from the user's account

- 100 AceTime tokens (contained within 100 CHT) are transferred to RewardUploadersManager contract for distribution among viewers through a "lottery" system

- broadcaster fee: 1 stablecoin (100 hours * 0.01)

- distributor fee: 1.5 stablecoins (100 hours * 0.015)

- 2.5 stablecoins are deducted from the user (1 + 1.5) and distributed as follows:

- 1 is transferred to the broadcaster

- 1.5 is transferred to the distributor

- 0.02 stablecoin is deducted from the user (system transaction fee)

Content Provider Token¶

Content Provider Tokens are created by content providers and will be used in the future to access their services and products, as either a subscription or a one-time purchase. These tokens are non-fungible (NFT) and conform to the ERC-721 standard.

Content providers should issue these tokens for the following purposes:

- To tokenize the access and payment mechanism for their services and products, with options for subscriptions or one-time access (with time restrictions)

-

To create personalized pools with the "Premium Pool" service function

The "Premium Pool" service allows any broadcaster (content provider or OTT service) to create pools with a common subscription or equal access conditions to their services, thus eliminating the need for users to register and purchase subscriptions for each individual OTT service. This eliminates the problem of "subscription fatigue" and makes the service more convenient and attractive for both premium content creators and consumers.

In brief, the problem of "subscription fatigue" is that too many streaming services (about 300 only in the US) lead to growing consumer disappointment due to the need for multiple subscriptions and services. 43% of those surveyed by Deloitte last year admitted to "giving up" the search for content, and 48% said it was difficult to find what they wanted to watch on different services.

Similarly, a study conducted in October 2019 by TV Time and United Talent Agency (UTA) showed that 70% of respondents believe that there will soon be too many streaming services. 87% said that services are becoming too expensive. Respondents also expressed disappointment with the need to switch between different services (67%), difficulties setting up and managing accounts (58%), and the inability to easily find content (45%).

The amount paid by the user for a subscription to a personalized pool is proportionally distributed by the Distribute Subscriptions smart contract among its participants (content providers), based on the percentage of total time spent by the subscriber playing the content of one or another pool participant (for which the calculation is made), compared to the total time spent by the subscriber playing the content of other pool participants. Details of the distribution algorithm can be found in the smart contract description (a fully open and transparent system without any possibility of manual control or interference in its operation).

-

To aggregate external content within the service

This type of token allows the content provider to legally add to their service content from any copyright owners, other content providers, and broadcasters participating in the Network. This is made possible through the use of the Ace Stream and Ace Maker smart contract technologies, which provide a necessary legal framework, reliable protection for all Network participants, and effective distribution mechanisms for maximum benefit for all parties.

-

Ace Stream P2P CDN Utilization

The use of Ace Stream P2P CDN enhances the audio-visual quality and stability of transmissions in existing services while reducing content delivery costs by a factor of 10 compared to traditional centralized technologies. This allows for broadcasting to an unlimited number of simultaneous viewers anywhere in the world without technical limitations.

Optimizing Financial Flows for Issuers

This type of token does not encapsulate AceTime tokens and all P2P CDN traffic settlements are made based on actual consumption. The token features a demand-based issuance and activation mechanism to avoid double spending on the Ethereum network.

The system fee for token issuance is 15% of the total volume of tokens emitted and can be changed by a DAO vote. Fee payments are made in stablecoins at the time of token sale, when the user pays the content provider for the purchased token.

Token Issuance¶

The issuance of tokens of this type is carried out by the ContentAccessManager smart contract. The content provider can independently (without the involvement of any authorized system participants) carry out the issuance of this type of token through any convenient network portal, by paying a one-time registration fee.

Registration of Issuance¶

Registration is performed through the registerAccessToken method of the ContentAccessManager contract:

- Any network account can be the issuer.

- The issuer must register in the network.

- The issuer pays a one-time registration fee (a small fixed amount set by system settings).

- After registering in the network, the issuer can issue an unlimited number of tokens as needed.

- The issuer pays a transaction fee in the Ethereum network.

Registration Parameters¶

accessDuration: The duration of the access (in seconds)contentList: A reference to the document with a list of content identifiers that access is granted toprice: The price of the token in stablecoins

Token Circulation¶

The ContentAccessManager smart contract enables unlimited automatic issuance of any token registered in the system using the following algorithm:

- A user calls the

ContentAccessManagercontract to purchase a token. - The payment for the token is deducted from the user and distributed as follows:

- A portion is received by the Ace Maker DAO (system fee)

- The remainder is reserved for settlement (refer to the “Settlements” section)

- The contract emits the token and transfers it to the user.

- The user pays a transaction fee in the Ethereum network.

To gain access to the issuer's service, the token must be activated. A user of the issuer's service who holds a token can activate the token directly on the issuer's portal (on the website, in the app, etc.) or through any other convenient portal in the network

Settlements¶

Content provider's users can access the services of other system’s participants. In this scenario, payment for these services is based on usage and facilitated by the token issuer, which is the content provider. The settlements that can occur include:

- Payment for P2P CDN traffic usage

- Provision of copyright holder tokens for access to their content

- Payment for broadcaster services

In the event that the content provider's account lacks sufficient funds, the corresponding service will automatically be disconnected and become unavailable to the content provider's users.

For the benefit of content providers, a system for reserving funds for settlements has been implemented. This system streamlines the settlement process and reduces the risk of service interruption. It operates as follows:

- Funds received from the user during token issuance are reserved for settlements

- As the user consumes services, the reserved stablecoins are used to pay for these services if necessary

- Unused funds from the reserve are unlocked in equal portions every 28 days starting from the moment the token is activated, until the token's validity period expires (refer to the "Unlocking the Reserve" example).

IMPORTANT: The reserve system cannot guarantee that the content provider has sufficient funds for settlements, therefore it is recommended that content providers closely monitor their balance.

It is important to note that the content provider acts as a distributor for the system and will receive a distributor's fee where applicable.

Contracts Algorithms¶

Token Registration¶

Registration is performed using the registerAccessToken method, which:

- Records the token parameters (

accessDuration,contentList,price) in the blockchain - Withdraws payment for registration (a fixed number of stablecoins, system setting) from the issuer

- The issuer pays the transaction fee in the Ethereum network

Token Issuance¶

Issuance is performed using the issueAccessToken method. This method is called by the issuer's service user who wants to purchase a token:

- The token price in stablecoins is withdrawn from the user

- The received stablecoins are distributed:

- A portion goes to Ace Maker DAO, in the amount of the system fee

- The remainder is reserved for settlements (see “Settlements” section)

- A new instance of the token is emitted and transferred to the user

- The user pays the transaction fee in the Ethereum network

The user can activate the token immediately during issuance by passing the autoActivate=1 parameter to the issueAccessToken method. This will save on Ethereum network fees by not launching a separate transaction for token activation.

Token Activation¶

Activation is performed using the activateAccessToken method. This method is called by the current token owner:

- The token status changes to

active - The activation date and time are recorded in the token

- The token owner pays the transaction fee in the Ethereum network

Examples¶

Registration

The following system configurations are used in the example:

- Registration fee - 100 stablecoins

- System fee - 15%

Alice (the content provider) wants to issue access tokens for her service. To do this, Alice visits the network portal and fills out the token registration form with the following fields:

- Access duration - 28 days

- Price - $5

- Link to the content list - Alice uploads a link to her service playlist here.

Next, Alice clicks the "Register" button, signs the transaction in her crypto wallet, and pays the transaction fee on the Ethereum network.

After the transaction is confirmed, the ContentAccessManager smart contract performs the following actions:

- Alice is charged 100 stablecoins (emission fee)

- Alice's token is added to the list of tokens registered in the system.

Now Alice can sell her tokens using the tools provided by the community (portals, SDKs).

Token Purchase and Activation

Bob (the user) wants to purchase access to Alice's service. To do this, he visits Alice's portal or any of the community portals and buys a token there:

- He clicks the "Buy" button on the portal

- He signs the transaction in his crypto-wallet

- He pays the transaction fee in the Ethereum network

- The cost of one token, 5 stablecoins, is deducted from Bob's account and distributed as follows:

- 0.75 stablecoins are deposited into the Ace Maker DAO treasury (15% system fee)

- 4.25 stablecoins are reserved for settlement (see the settlement example below)

- A new token instance is issued and transferred to Bob's account

Bob can activate the token either at the time of purchase or later, on Alice's portal or on one of the community portals, or in applications that support the Ace Maker protocol. An activated token gives Bob the right to use Alice's service for 28 days starting from the activation date.

Settlements

When conducting settlements, funds reserved at the time of token purchase are used. In this case, it is 4.25 stablecoins.

Let's consider several examples of settlements depending on whether Alice is a broadcaster and whether Bob viewed the content requiring the copyright holder tokens.

Example 1

In this example, Alice is not only a distributor but also a broadcaster, and also has rights to all the content she provided Bob with access to. In other words, copyright holder tokens are not required to access the content. Alice only has to pay for the traffic. If Alice has AceByte tokens in her account - they will be used to pay for the traffic. If not - they will be purchased using funds from the reserve.

Input:

- Access cost: 5 stablecoins

- Access duration: 28 days

- Over the 28 days, Bob watched content for 50 hours and used 150 GB of traffic

- 1.5 AceByte is required to pay for the traffic (since 1 AceByte = 100 GB)

- The current market price of one AceByte token: 1 USD

Settlements:

- Bob is charged 5 stablecoins (access cost)

- 0.75 stablecoin is transferred to the Ace Maker DAO treasury (15% system fee)

- 4.25 stablecoins are reserved for settlements

- 0.02 stablecoin is paid from the reserve for system transaction fee

- If Alice has AceByte tokens:

- 1.5 AceByte is charged from Alice's account and transferred to the smart contract for distribution through the "lottery" system

- The remaining reserve (4.23 stablecoins) is unlocked and transferred to Alice's account

- If Alice does not have AceByte tokens:

- Automatic purchase of AceByte is performed in the required volume:

- 1.5 AceByte is purchased through the AceByteManager smart contract (Ace Stream DAO) at a cost of 1.5 stablecoin

- 1.5 AceByte is transferred to the smart contract for distribution through the "lottery" system

- The remaining reserve (2.73 stablecoins) is unlocked and transferred to Alice's account

- Automatic purchase of AceByte is performed in the required volume:

Example 2

In this example:

- Alice is both a distributor and a broadcaster

- Dave is the rights holder who issued tokens with broadcasting rights:

- Token name - CHT

- Current fair price - 1 CHT = 0.05 stablecoin

- Cost of encapsulated AceTime token - 0.01 (current price, including protocol discount)

- OwnerNFT holders fee - 10%

- Access cost: 5 stablecoins

- Access duration: 28 days